Houston Tech Sector Surges as Texas Claims National Leadership in Technology Employment Growth

Houston Metro Area Set to Add 3,271 New Tech Jobs in 2025 as State Leads Nation with 40,051 Positions

Houston's technology sector is experiencing unprecedented growth in 2025, with the metro area projected to employ 158,176 tech professionals by year's end—a 2.1% increase from 2024's 154,905 positions, according to CompTIA's State of the Tech Workforce 2025 report. The growth represents part of a broader Texas technology boom that has positioned the Lone Star State as America's undisputed leader in tech job creation, with projections showing 40,051 new tech positions statewide in 2025—a dramatic surge from just 8,181 jobs added in 2024.

The Houston area ranks eighth nationally among major metropolitan areas for absolute tech job growth, adding an estimated 3,271 positions this year. This expansion builds on the remarkable six-year growth that has seen Houston's tech workforce increase by 16.6% from 2019 to 2025, cementing the city's position as a major technology hub in the American South.

Houston's Tech Revolution Driven by AI

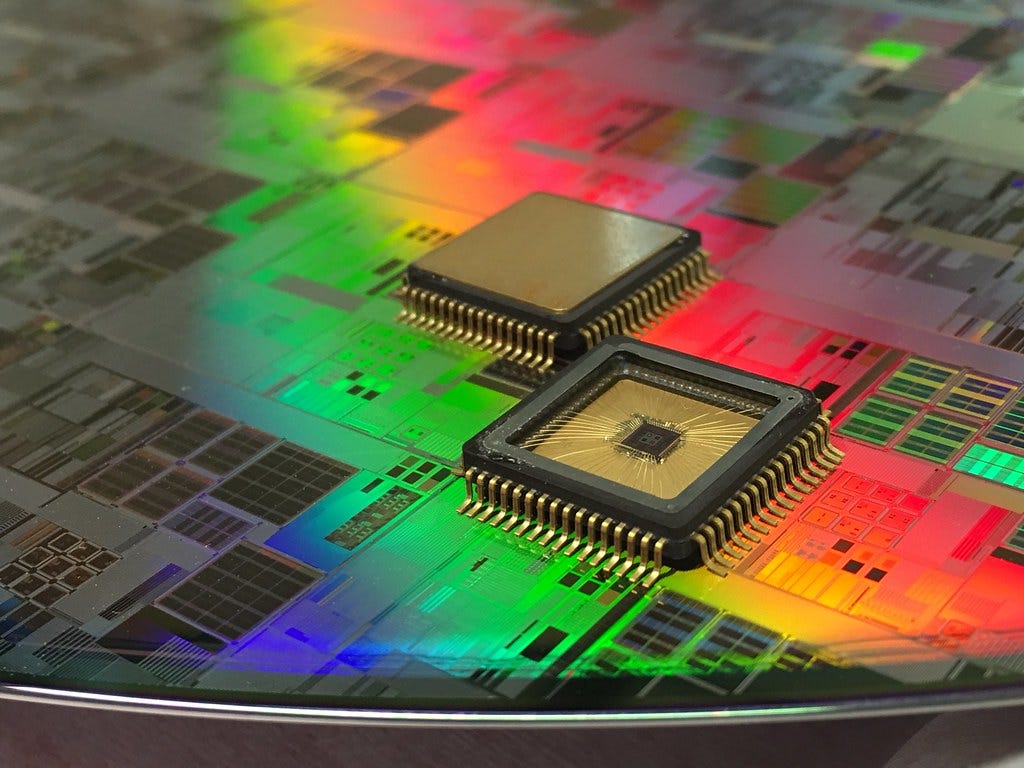

The surge in Houston's tech employment reflects fundamental shifts in the industry, with artificial intelligence infrastructure and semiconductor manufacturing driving much of the growth. Major technology companies are making substantial commitments to the region, led by semiconductor giant Nvidia's partnership with electronics manufacturer Foxconn to build an AI supercomputer manufacturing facility in Houston.

"The engines of the world's AI infrastructure are being built in the United States for the first time," Jensen Huang, founder and CEO of Nvidia, said in announcing the Houston facility. The plant, expected to begin production within 12-15 months, represents part of Nvidia's broader $1 million square feet of U.S.-based production capacity expansion.

Houston's tech ecosystem now supports over 235,000 tech workers who contribute $28.1 billion to the regional economy, according to recent industry analysis. The sector's growth trajectory suggests Houston could reach 317,000 tech positions by the end of 2025, with some projections showing 15% growth in certain high-demand specializations.

Semiconductor Investment Fuels Statewide Technology Renaissance

The Texas technology boom receives significant support from state-level semiconductor initiatives, including the $1.4 billion Texas Semiconductor Innovation Fund launched in 2023. The fund allocated $698.3 million for semiconductor incentives while dedicating another $660 million to establish research and development centers at the University of Texas at Austin and Texas A&M University.

"Texas has the innovation, the infrastructure, and the talent to continue to lead the American resurgence in critical semiconductor manufacturing and the technologies of tomorrow," Governor Greg Abbott said in supporting the initiative. The fund specifically targets semiconductor research, design, and manufacturing activities across the state.

Apple has also committed to Houston's manufacturing expansion, announcing plans for a 250,000-square-foot factory that will produce servers for the company's data centers in support of AI business operations. This Houston facility represents part of Apple's four-year, $500 million nationwide expansion unveiled in February 2025.

Dallas Dominates While Austin Faces Headwinds

While Houston shows strong growth, Texas's technology landscape reveals significant regional variations. Dallas leads all American metropolitan areas with a projected 13,997 new tech jobs in 2025, while Austin ranks fifth nationally with 7,750 new positions. San Antonio rounds out Texas representation at 21st nationally with 1,617 new tech jobs expected.

However, recent industry analysis suggests some Texas markets may be losing momentum. Austin, previously a post-pandemic growth leader, experienced a 6% drop in headcount at venture capital-backed startups in 2024. Houston showed an even steeper decline of 10.9% in startup employment, according to SignalFire's State of Tech Talent Report.

"Texas cools off: Are Austin and Houston losing their luster?" the SignalFire report questioned, citing lagging infrastructure, cultural mismatches, and fluctuating housing costs as factors motivating startup employees to relocate closer to traditional tech hubs. The trend reflects broader industry consolidation around established centers like San Francisco, Seattle, and New York City.

High-Paying Opportunities Attract National Talent

Despite startup sector challenges, Houston's broader tech employment market offers substantial financial incentives for technology professionals. Data scientists in Houston earn average salaries of $108,000 annually, while cloud computing specialists can earn up to $180,000. Machine Learning Engineers command $165,999, and Cloud Architects reach $146,071 in annual compensation.

The salary advantages become more pronounced when adjusted for Houston's relatively low cost of living, with one-bedroom apartments averaging just $1,232 monthly—significantly below costs in traditional tech hubs like San Francisco. This cost-of-living advantage, combined with competitive salaries, positions Houston as an attractive destination for technology professionals seeking career advancement without the financial pressures of coastal markets.

Innovation infrastructure continues expanding through facilities like The Ion, which offers 266,000 square feet of space for tech companies in Houston's innovation district. The facility anchors a broader ecosystem supporting startups and established technology companies across multiple specializations.

Skills in Demand

Houston's tech job growth concentrates in specific high-demand skill areas, with Python and JavaScript programming languages showing particularly strong employer interest. Cybersecurity roles project 18% growth, while healthcare technology positions benefit from new digital initiatives across Houston's massive medical sector.

The healthcare technology intersection proves especially significant given Houston's status as home to the world's largest medical center. Digital health initiatives, telemedicine platforms, and medical AI applications create unique opportunities for technology professionals interested in healthcare applications.

Cloud computing skills remain in exceptionally high demand, with positions requiring expertise in Amazon Web Services, Microsoft Azure, and Google Cloud Platform commanding premium salaries. The growth reflects broader business migration to cloud-based infrastructure and the increasing importance of AI-ready computing platforms.

Manufacturing Renaissance Transforms Industrial Landscape

Beyond traditional technology roles, Houston benefits from a broader manufacturing renaissance focused on advanced technology production. Foxconn's recent $142 million acquisition of a 1 million square foot industrial campus demonstrates the scale of manufacturing investment flowing into the region.

The Nvidia-Foxconn partnership represents a particularly significant development, as it marks "the first time Nvidia has built AI supercomputers entirely in the U.S." This domestic production capability addresses supply chain concerns while creating high-value manufacturing jobs in the Houston area.

"Houston continues to prove itself as a powerhouse for industrial growth, driven by its strategic location, access to skilled labor, and robust infrastructure," John Lettieri, market officer for Dalfen's Central region, told Commercial Property Executive. "As AI technologies reshape the industrial landscape, we're seeing a sharp uptick in demand for best-in-class facilities that can support advanced manufacturing operations."

State Leadership Drives National Technology Competitiveness

Texas's technology employment leadership extends beyond individual metropolitan areas to establish statewide dominance in tech job creation. The state ranks second nationally for total tech workforce size with 972,747 workers in 2024. Looking ahead to 2035, Texas projects 24% of all new tech jobs nationally, ranking fourth among all states for long-term technology employment growth.

The Federal Reserve Bank of Dallas forecasts Texas will add over 240,000 total jobs in 2025, though it noted a recent slowing in overall job growth. However, technology sector growth continues outpacing general employment trends, reflecting the industry's strategic importance to Texas’s economic development.

Luis Torres, Dallas Fed senior business economist, noted that while "job growth slowed in March due to declines in oil and gas, leisure, manufacturing, and professional and business services jobs," technology-related sectors, including education, health, and construction, showed "strong employment gains".

Sustained Growth Amid Industry Transformation

As 2025 progresses, Houston's technology sector appears positioned for continued expansion despite broader economic uncertainties. The combination of major corporate investments, state-level support for semiconductor development, and growing demand for AI infrastructure creates multiple growth drivers for sustained job creation.

The concentration of AI manufacturing capabilities, from Nvidia's supercomputer production to Apple's server manufacturing, positions Houston as a critical node in America's technology supply chain. These developments suggest the current growth trajectory may continue well beyond 2025 as companies prioritize domestic production capabilities and AI infrastructure investment.

However, the industry faces potential challenges from talent competition with established tech hubs, infrastructure development needs, and the broader economic impacts of return-to-office policies that may influence location decisions for both companies and individual workers. Houston's success in maintaining its technology growth momentum will likely depend on continued corporate investment, infrastructure development, and the city's ability to compete with traditional tech centers for top-tier talent.